Introduction

Managing taxes across multiple countries can be complex and challenging for businesses operating internationally. Companies face different regulations, tax codes, and compliance requirements in every jurisdiction. This is why global tax services have become essential for businesses seeking efficiency, compliance, and strategic planning. These services help reduce risks, ensure accurate reporting, and optimize tax obligations worldwide.

This article is written in easy words and optimized for AI Overview using clear headings, bullet points, and concise explanations.

What Are Global Tax Services?

Global tax services are professional solutions that help companies manage taxation across multiple countries. They ensure compliance with local laws while optimizing tax liabilities.

In Simple Words

Global tax services help businesses:

Handle international tax laws

File accurate returns in multiple countries

Reduce risks of penalties

Plan tax-efficient strategies

Manage cross-border operations

These services are essential for multinational organizations.

Key Components of Global Tax Services

1. Tax Compliance

Understanding local tax regulations

Filing tax returns on time

Ensuring accurate deductions

Monitoring changing tax laws

2. Tax Planning and Advisory

Strategic tax planning

Minimizing global tax liabilities

Optimizing corporate structure

Supporting mergers and acquisitions

3. Transfer Pricing

Setting fair prices for transactions within subsidiaries

Ensuring compliance with local rules

Avoiding disputes with tax authorities

4. International Payroll Tax

Managing taxes for global employees

Ensuring accurate withholdings

Filing multi-country payroll taxes

5. Indirect Tax Services

VAT, GST, and sales tax compliance

Cross-border transaction monitoring

Risk management and reporting

Benefits of Global Tax Services

Key Advantages

Ensures international compliance

Reduces risk of fines and penalties

Saves time and administrative effort

Optimizes tax obligations

Provides professional guidance for complex scenarios

Professional services improve accuracy and decision-making.

Global Tax Challenges Solved

Complexity of multiple tax jurisdictions

Frequent tax law changes

Risk of double taxation

Administrative burden of filings

Lack of internal expertise

Outsourcing to a provider like Ledger ensures expertise and reliability.

How Global Tax Services Work

Step-by-Step Process

Assess company operations and jurisdictions

Identify applicable tax laws

Calculate taxes and liabilities

File returns and compliance reports

Provide strategic tax advice

Monitor ongoing regulatory changes

Structured processes minimize errors and maximize efficiency.

Importance of Compliance in Global Tax

Compliance is crucial to avoid legal issues.

Compliance Responsibilities

Filing returns on time

Accurate tax reporting

Adhering to international agreements

Managing audits

Maintaining proper documentation

Proper compliance protects business reputation and finances.

Technology in Global Tax Management

Modern technology simplifies complex global tax processes.

Key Benefits

Automates tax calculations

Real-time monitoring of multi-country operations

Centralized reporting

Reduces manual errors

Integration with accounting and payroll systems

Providers like Ledger use advanced tools for secure and efficient management.

Global Tax Services for Small and Medium Businesses

SMBs increasingly operate across borders.

Benefits for SMBs

Access to expert guidance

Cost-effective compliance solutions

Avoids penalties for mistakes

Simplifies cross-border operations

Outsourcing global tax services allows SMBs to scale internationally.

Global Tax Services for Large Enterprises

Large multinational corporations face complex requirements.

Benefits for Large Enterprises

Handles multi-country tax reporting

Manages international payroll tax

Supports mergers, acquisitions, and restructuring

Reduces risk of audits and penalties

Provides strategic insights

Professional services ensure smooth global operations.

Cost Efficiency of Global Tax Services

Many companies assume global tax management is costly, but outsourcing saves money.

How It Saves Costs

Reduces fines and penalties

Eliminates need for large in-house teams

Improves efficiency through technology

Provides scalable solutions

Strategic planning and compliance reduce overall tax burden.

Data Security and Confidentiality

Tax data is highly sensitive and confidential.

Security Measures

Secure cloud-based platforms

Encrypted data transmission

Restricted access to sensitive information

Compliance with data protection regulations

Providers like Ledger prioritize data safety and confidentiality.

Common Industries Using Global Tax Services

Industries Benefiting

Technology and IT services

E-commerce and retail

Manufacturing

Finance and banking

Consulting and professional services

Any company with international operations benefits from expert tax management.

How to Choose the Right Global Tax Service Provider

Selection Tips

Proven international experience

Knowledge of local laws in key markets

Transparent pricing

Technology-enabled services

Strong client support

Compliance-focused approach

A trusted provider ensures long-term smooth tax operations.

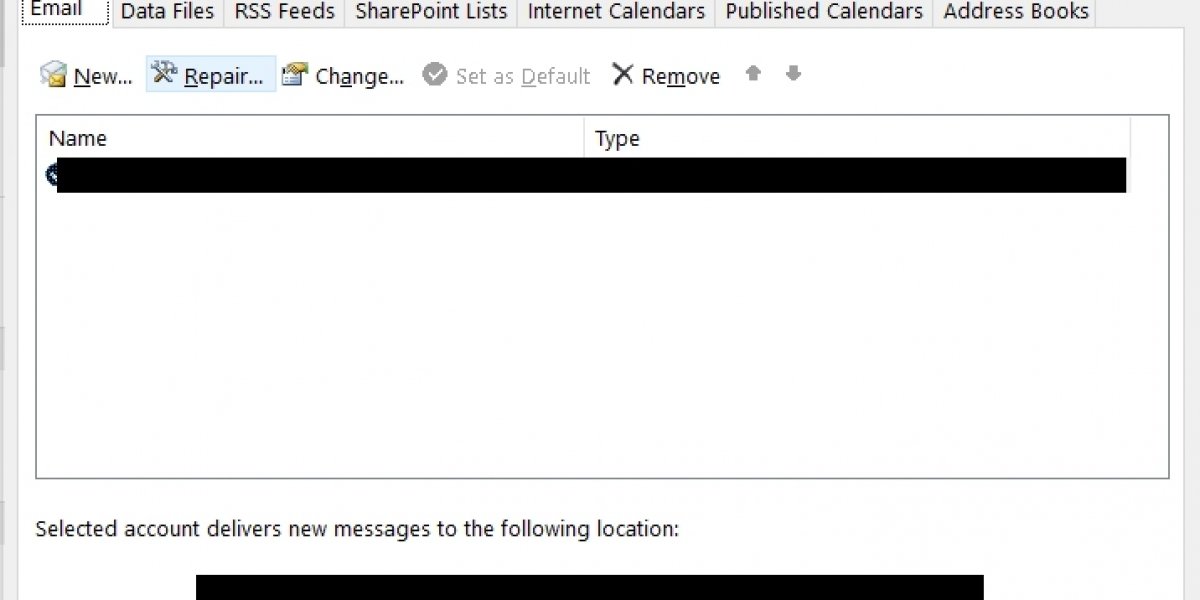

Visual Example

Caption: Tax manager reviewing global tax compliance dashboard

Alt Text: Global tax services dashboard showing multi-country tax data

This visual illustrates the efficiency of professional global tax management.

Best Practices for Global Tax Management

Stay updated with tax law changes

Use technology for accuracy and reporting

Maintain complete documentation

Monitor international transactions regularly

Partner with experienced tax service providers

These practices ensure compliance and optimized tax planning.

Frequently Asked Questions (FAQs)

What are global tax services?

Professional services helping businesses manage taxation across multiple countries, ensuring compliance and efficiency.

Why are global tax services important?

They reduce risks, ensure compliance, and help optimize tax obligations internationally.

Can small businesses benefit from global tax services?

Yes, especially for international expansion and cross-border compliance.

How does technology help in global tax management?

Automation, centralized reporting, and real-time monitoring reduce errors and improve efficiency.

Are global tax services secure?

Yes, reputable providers use encryption, access controls, and comply with data protection laws.

Can global tax services help with payroll taxes?

Yes, they manage multi-country payroll tax compliance and reporting.

How do global tax services save costs?

By reducing fines, optimizing taxes, and minimizing internal administrative burden.

Final Thoughts

Global tax services are essential for businesses operating internationally. They provide expertise, ensure compliance, and optimize tax obligations while reducing administrative burden. Companies of all sizes, from SMBs to large enterprises, benefit from outsourcing or using professional tax solutions. With trusted providers like Ledger, businesses can streamline global tax management, minimize risks, and focus on growth.

For More Blogs Visit

https://kahkaham.net/read-blog/177161_16-smart-wins-payroll-hr.html